The payment process is an integral part of any online business. Learning the basics of this process ensures secure and smooth transactions whenever the customer makes a payment. When understanding the function of the payment method, it is mandatory to know how exactly the process takes place and how the players involved are playing their parts.

When looking at the payment system it is easy to set up. Payment processing involves a set of actions that start a business’s movement to begin a digital payment transaction. It consists of processing the card, which opens payment gateways, gives way to secured transactions, and communicates with the issuing bank about the customer’s transaction account.

Key Players Of Payment Processing

The payment process is a process of automation of transactions between the customer and the merchants involved via secure internet connections. Generally, third-party services handle the process, verifying the transaction and confirming whether to accept or decline any particular transactions on the merchant’s behalf. Knowing the key players involved in this process helps better understand the concept.

The Customer

The buyer, also known as the customer, gives the card for transactions online. The same card could also get used in physical stores through Point of Sale (POS) systems.

The Merchant

The merchant is the supplier who supplies products or services for which an amount gets charged, and the merchant is authorized to accept customers’ payments.

The Acquirer

The acquirer is usually a bank or a financial institution that holds and manages the merchant’s account details. They receive payments from the cards processed on the merchant’s behalf.

Card Network

Credit card networks are the companies like Visa, MasterCard, American Express, and other debit or credit cards that facilitate payment processing between card issuers and merchants.

The Issuer

They are the credit card issuing authority, including financial institutions, banks, or companies. They are authorized to print and give the cards.

Processor Of Payment

The payment processor is the gateway that processes the payment details through card networks and the customer’s issuing bank. It gives payment approvals to the acquiring bank, the merchant, and the customer.

Payment Processing Fees

Nowadays, a tiny percentage of the public carries cash for buying goods and services. Most buyers prefer paying via debit or credit cards, mainly because of the ease of having that plastic money compared to the actual weighty hard cash. The business or the merchants that accept cards for online settlement get charged a fee per transaction, which gets referred to as a payment processing fee.

When a merchant processes the transaction of a customer via card or online, a fee gets charged. This settlement fee gets assigned to the merchant by the processing entity.

The settlement fees depend upon various factors like the type of card (corporate, business, reward, or millennia cards) and the risk associated with this transaction. Apart from this, the payment processors have different sets of pricing models. It gets taken into account depending on the cards in a transaction.

Factors Affecting Transaction Fees

The factors that affect transaction fees getting charged to businesses accepting card payments are.

Exchange Rate

The exchange rate, also known as the interchange rate, is the fees charged by the issuer of cards like Mastercard, Visa, and other card issuers, every time the customer swipes the card for settlement.

This fee helps the issuer bank cover the basic handling costs, along with the risk for approval of the sale and also includes the risk of defrauding transactions that might occur.

Depending upon the issuer, each network sets the interchange fees separately. The type of card used for transactions also affects this rate. It also includes the risk of the merchant accepting payment online, directly swiping, or even typing the details into the Pos terminal.

Provider Fee

The merchant account charges this provider fee. For card settlement processing, the business must approve the interlinking of the merchant account with the card network.

After the process, the account lets the business accept card payments, and the merchant account provider deposits the amount in the merchant’s bank account as per the agreement.

Apart from the interchange fee rate, the merchant account provider charges a merchant provider fee. This fee varies as per the volume of transactions and type of business.

Apart from the fee charged per transaction, it also demands a monthly maintenance fee and an additional fee for disputed transactions initiated by the customers.

Depending On The Card Processed

The processing fees charged for the settlement will also depend upon how the card is processed. Customers can use cards differently by directly swiping the card for in-store transactions, online transactions, over the phone, and many other ways. All these types of transactions carry risks at different levels.

Payments made in front of a cashier in-store by directly swiping the card are less risky, and it has lower transaction fees. There is a higher level of risk attributed to phone or online transactions, as these transactions could get done by frauds who stole the cards, which attracts higher processing fees.

Types Of Fees

There are various types of fees included while processing the payment. They include,

Flat Rate Fees

The processor charges these fees for all transactions, despite any card used for in-store, physical, or online purchases.

As per the total transaction amount, a percentage of the flat rate gets charged on the purchase amount. Few other processors charge this and, along with it, charge extra additional fixed fees.

Merchants not handling large volumes of transactions prefer flat rate fees, allowing them to negotiate a price with the processor. The business owners are aware of the costs as a settlement gets processed.

Interchange Plus Pricing Strategy

With this pricing strategy, the merchant gets charged by the payment processor with an interchange fee plus a fixed fee or a percentage per transaction.

Interchange plus pricing strategies are more complex to understand when compared with flat rate plans. It becomes challenging to make sense of the bank statements when it arrives at the end of the month.

Tiered Pricing Model

The tiered fees model takes up the interchange fees and divides them into three categories depending upon the risks of a particular transaction. These three categories are:

Qualified Rate

If the transactions meet all the payment processor’s requirements, the merchant gets a qualified rate per transaction.

That transaction that gets swiped physically by the customer with the standard credit car comes in this category, as it carries a low risk that attracts low rates.

Mid Qualified Rate

The merchant gets downgraded to this rate if the transactions do not meet all the requirements of payment processors.

Online transactions over the phone and direct mail orders come in this category as the credit card is not physically available. As nothing can be verified face to face, such transactions come under higher risk, and the business will get charged a higher rate.

Non-Qualified Rate

Transactions that do not pass for qualified and mid-qualified rates fall under the non-qualified rate category. This category includes transactions with reward cards, signature cards, and e-commerce transactions. The non-qualified rate charges the highest fees.

Conclusion

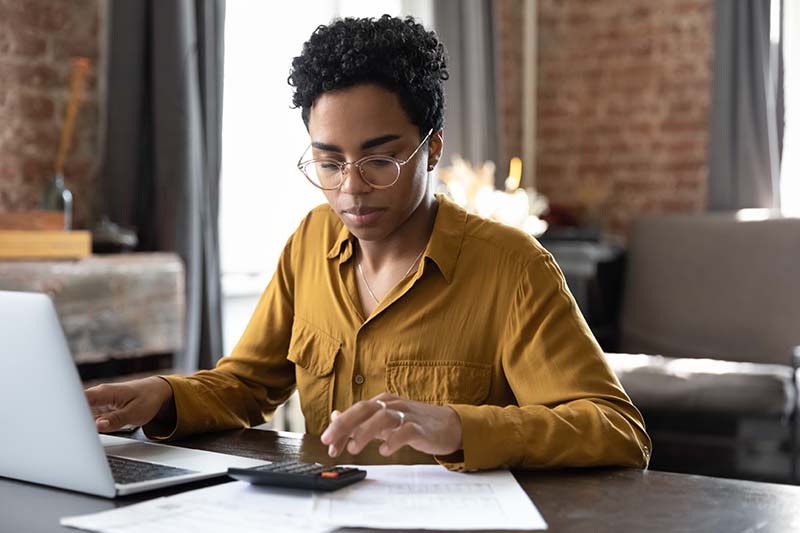

The fees charged by the payment processor on the merchant for processing cards and other online settlements are known as payment processing fees.

The processor decides the processing fees depending on the pricing model and the risk involved in each transaction.

It is always necessary to fit those digital settlement processes that could get easily integrated with the existing system in the company. Whether the process is for the sales amount or tax collection, the company’s payment processing system should help in all the initiatives.