When it comes to stock trading, no country stays behind. It is a great way to earn money and boost the economy at the same time. There is nothing like earning through this. Once you get a hone, you will not stop stock trading.

Benefits of Stock Trading

Helps you save money:

If you are interested in long-term investing, stock trading can make managing your shares very simple. The best way in which money can be saved for the long term

Earn money:

When you are investing for the long term, online trading can make dealing with shares very simple. stocks that will give you good returns on your cash because volatility ensures that they can go through the roof and remain well below certain levels at different times. If you can leverage the risk effectively while trading online, expect to make healthy profits offline.

Earn dividends:

Stock trading might not help you with fast incomes, but they yield decent dividends and help you achieve stability in life. For the average trader, online trading is the obvious choice as brokers are usually only used by the top-tier businesses, wealth management firms, and high-net-worth individuals.

Helps you reduce some of your costs:

Online stock market trading has the advantage of reducing costs. By bringing years of experience to the trade, brokers make a living through stocks. However, they can also be extremely expensive. Brokers sometimes charge a brokerage fee and a percentage of the earnings, while online brokerage houses charge a flat rate per transaction. Choosing to trade online will allow you to take advantage of a lower rate.

Now, getting back to Hong Kong, it is a significant player on the world stage when it comes to stock trading. Here are some of the essential tools for stock trading in Hong Kong:

The Stock Market Forums

The Hong Kong Stock Exchange (HKEX)

The HKEX is one of the biggest exchanges in the world and is a crucial centre for stock trading in Hong Kong. It offers a broad set of products and services, including equities, bonds, and derivatives. Even if you are a beginner, you must know about HKEX. It will help gradually and eventually.

Bloomberg Terminal

Bloomberg terminals are an essential tool for stock traders in Hong Kong. They offer real-time financial data and news and robust analysis tools. If you are interested

Reuters Terminal

Like Bloomberg terminals, Reuters terminals are also essential for stock traders in Hong Kong. They offer real-time financial data and news and robust analysis tools.

The Hang Seng Index

The Hang Seng Index is the most important stock market index in Hong Kong. It tracks the performance of the most extensive stocks on the HKEX.

The HSI Futures Contract

The HSI Futures Contract is a binding futures contract on the HKEX. It tracks the accomplishments of the Hang Seng Index.

The Stock Connect Scheme

The Stock Connect Scheme is a scheme that allows investors to trade stocks between Hong Kong and Shanghai/ Shenzhen markets.

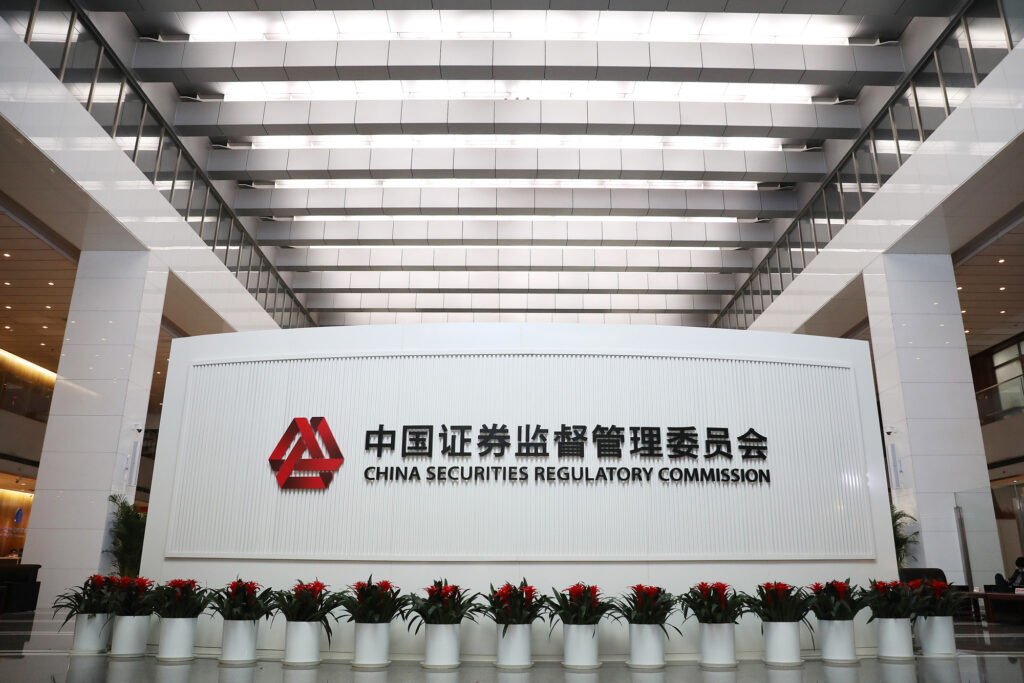

The China Securities Regulatory Commission (CSRC)

The CSRC is the Chinese financial regulator and is responsible for regulating the securities markets in China

The Shanghai Stock Exchange (SSE)

The SSE is the most comprehensive stock exchange in China and is a crucial centre for stock trading in China.

The Shenzhen Stock Exchange (SZSE)

The SZSE is the second-largest stock exchange in China and is a crucial centre for stock trading in China.

The People’s Bank of China (PBC)

The PBC is China’s central bank and is responsible for regulating the banking system and setting monetary policy.

The State Council of China

The CSRC is the central regulator of the securities industry in China. It also has a role in regulating the Hong Kong stock market.

The Securities and Futures Commission (SFC)

The SFC is the primary regulator of the securities and futures industry in Hong Kong. It plays a crucial role in regulating the Hong Kong stock market.

The Hong Kong Monetary Authority (HKMA)

The HKMA is the city’s de facto central bank. It regulates the banking system and issues currency, among other things.

The Strategies

Short selling

Short selling is a trading strategy that involves selling securities that you do not own and hoping to repurchase them at a lower price so you can profit from the difference.

Stop-loss orders

Stop-loss orders are instructions to buy or sell a security when it reaches a specific price. They are used to limit losses in a trade.

Limit orders

Limit orders are instructions to buy or sell a security at a specific price. They can use them to take profits or enter a trade at the desired price.

Market orders

Market orders guide buying or selling a security at the best available price. They are often used when time is of the essence.

Trailing stop-loss orders

Trailing stop-loss orders are stop-loss orders that are set to a percentage or dollar amount below the current market price. They are designed to protect profits in a trade.

Margin trading

Margin trading is borrowing money from a broker to buy securities. It can be used to amplify gains but also amplify losses.

Short selling margin

Short selling margin is the amount of money you need to borrow from your broker to short sell security.

Hedging

Hedging is the practice of protecting yourself from potential losses by taking opposite positions in related securities.

Arbitrage

Arbitrage is taking advantage of price discrepancies between securities on different exchanges.

ETFs

ETFs are funds that track a particular index or sector. They offer investors a way to gain exposure to several different securities with one investment.

Margin call

A margin call is when your broker demands that you deposit more money into your account to cover the losses on your positions. If you cannot meet the margin call, your broker can liquidate (sell) your positions to cover the losses.

To learn more, navigate to this website for more important stock trading tools.